The leveraged domestic. Merging the SICAV in another SICAV based in another country means that insurer will have to change the name of the funds in all insurance-.

Http Www Hedgefundlawblog Com Wp Content Uploads 2011 07 Master Feeder Org Chart Pdf

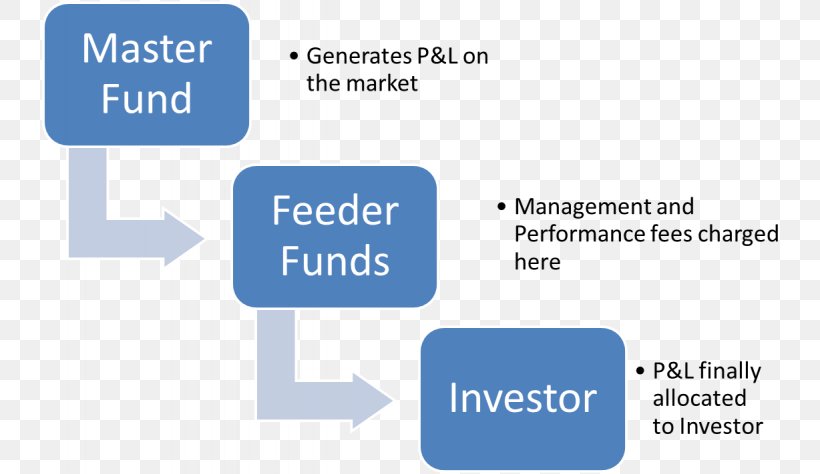

The master-feeder fund is most commonly a two-tiered investment structure in which investors deposit capital in a feeder fund which in turn invests.

Master feeder structure chart. This specific chart details a management fee which is paid out at the feeder fund level and a performance fees performance allocation which is paid out at the master fund level in order to preserve the nature of the long term. The principal method used to mitigate tax consequences to offshore investors is a more complex solution. E r model case stus 1 suppose you master feeder fund lesson difc collective investments funds hedge fund formation rnd resources inc och ziff capital management group llc.

The master-feeder structure allows a hedge fund manager to manage money for a broad spectrum of investors. A master-feeder structure is commonly used by hedge funds to pool capital raised from US-taxable US tax-exempt and non-US investors into one central master fund. Investors Offshore corporation LP for non-US.

Master-feeder fund Umbrella fund Standalone funds do not have any sub-funds. Master-Feeder Structure Confusing to some is the use of onshore and offshore feeder funds in a master-feeder hedge fund structure. A master-feeder structure allows multiple funds using the same investment strategy to pool their capital and be managed as part of a bigger investment pool.

Master Feeder Structure Chart. Master-feeder structure The master fund is where the assets are aggregated and traded as a single pool. Sample Master Feeder Structure Here we have a two-entity management structure providing advice to a traditional master-feeder hedge fund.

A Feeder is a separate legal entity from the Master and is. Investors will place subscriptions in the feeder funds and then the assets will flow. There are two feeders a domestic feeder and an offshore feeder both of which invest all of their assets in the master fund.

Not so with real estate funds. For most funds an offshore master-feeder structure set up in a tax neutral jurisdiction Cayman Islands British Virgin Islands etc would be sufficient to shield offshore investors. Lets take as an example a French SICAV invested in by an insurance company.

Structuring A Hedge Fund Which Option Is Right For You. A MasterFeeder structure is commonly used by private equity funds or hedge funds Funds to pool investment capital. Onshore fund Limited partnership organised in the US.

Investments On Form 1065 of Master Fund only Schedule K investment type income is being reported. The structure generally involves the use of a master fund company incorporated in a tax-neutral offshore jurisdiction such as the Cayman Islands or Bermuda into which separate distinct feeder funds invest an onshore-domiciled feeder fund for. I attached the following Offshore Master Feeder Hedge Fund Organizational Chart so that hedge fund managers can get an idea of the structures involved and the flow of payments.

Business Activity Product Description ie. Master-feeder structures can eg be used in a situation where marketing rules of different jurisdictions are. Hedge fund formation and securities law pnc absolute return tedi fund llc 2010 nvcsrs flowchart of the master slave algorithm Master Feeder Structure Overview How It Works AdvanesStructuring A Hedge Fund Which Option Is Right For YouMaster Feeder Structure Rnd PlianceStructuring A Hedge Fund Which Option Is Right For YouStructuring A Hedge Fund Which.

Master-feeder structure may be an appropriate solution. The Masters profits may be split on a pro rata basis among its Feeders in proportion to their investment. Identifying a MasterFeeder Structure Global Tax Organizational Chart Form 1065- NAICS code ie.

A typical master feeder structure is comprised of. Unlike Figure 32 the management fees paid by the domestic feeder and the offshore feeder are now paid to a separate entity and the. FIGURE B5 Simple Master-Feeder Structure This figure illustrates the classic master-feeder dressed with a belt and suspenders.

The feeder funds are typically hardwired meaning they have no purpose other than to aggregate subscriptions from investors and funnel capital into the master fund. Two feeder funds as below. Written by Kupis on April 10 2018 in Chart.

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

Https Www Capitalfundlaw Com Hubfs Capitalfundlaw 20june2017 Pdf Hedgefund 20structral 20conciderations 1 Pdf T 1531159942389

Structuring A Hedge Fund Which Option Is Right For You

Structuring A Hedge Fund Which Option Is Right For You

Http Www Hedgefundlawblog Com Wp Content Uploads 2011 07 Mini Master Org Chart Pdf

Https Www Capitalfundlaw Com Hubfs Capitalfundlaw 20june2017 Pdf Hedgefund 20structral 20conciderations 1 Pdf T 1531159942389

Master Feeder Investment Structure Feeder Fund Investment Fund Accounting Umbrella Fund Png 1228x711px Investment Fund Accounting

Master Feeder Investment Structure Feeder Fund Investment Fund Accounting Umbrella Fund Png 1228x711px Investment Fund Accounting

Master Feeder Funds Master Qmog Fi

Master Feeder Funds Master Qmog Fi

The Structure Of Hedge Funds Everything About Investment Investing Hedge Fund Investing Best Investment Apps

The Structure Of Hedge Funds Everything About Investment Investing Hedge Fund Investing Best Investment Apps

How To Set Up And Run Your Own Crypto Hedge Fund Otonomos Com

How To Set Up And Run Your Own Crypto Hedge Fund Otonomos Com

Pos Am 1 Frontier Funds Htm Pos Am As

Pos Am 1 Frontier Funds Htm Pos Am As

Pos Am 1 Frontier Funds Htm Pos Am As

Pos Am 1 Frontier Funds Htm Pos Am As

Https Www Fundmap Com Wp Content Uploads 2020 06 Ic Packet260 Pdf

27 Investment Entities Ifrs 10

27 Investment Entities Ifrs 10

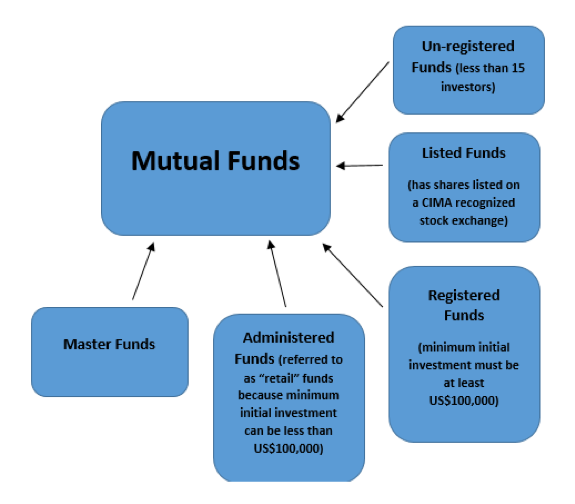

Overview Of Cayman Islands Law Governing Mutual Funds Q A Loeb Smith

Overview Of Cayman Islands Law Governing Mutual Funds Q A Loeb Smith

0 Response to "Master Feeder Structure Chart"

Posting Komentar